System Unavailable

Our apologies! Our system is temporarily unavailable. We will be happy to serve you over the telephone by calling 1-888-442-4625 or by emailing [email protected].

Indisponibilité du système

Nos excuses! Il y a une interruption temporaire de notre système. Nous aurons le plaisir de vous aider par téléphone en composant le 1-888-442-4625 ou par courriel à l’adresse

[email protected].

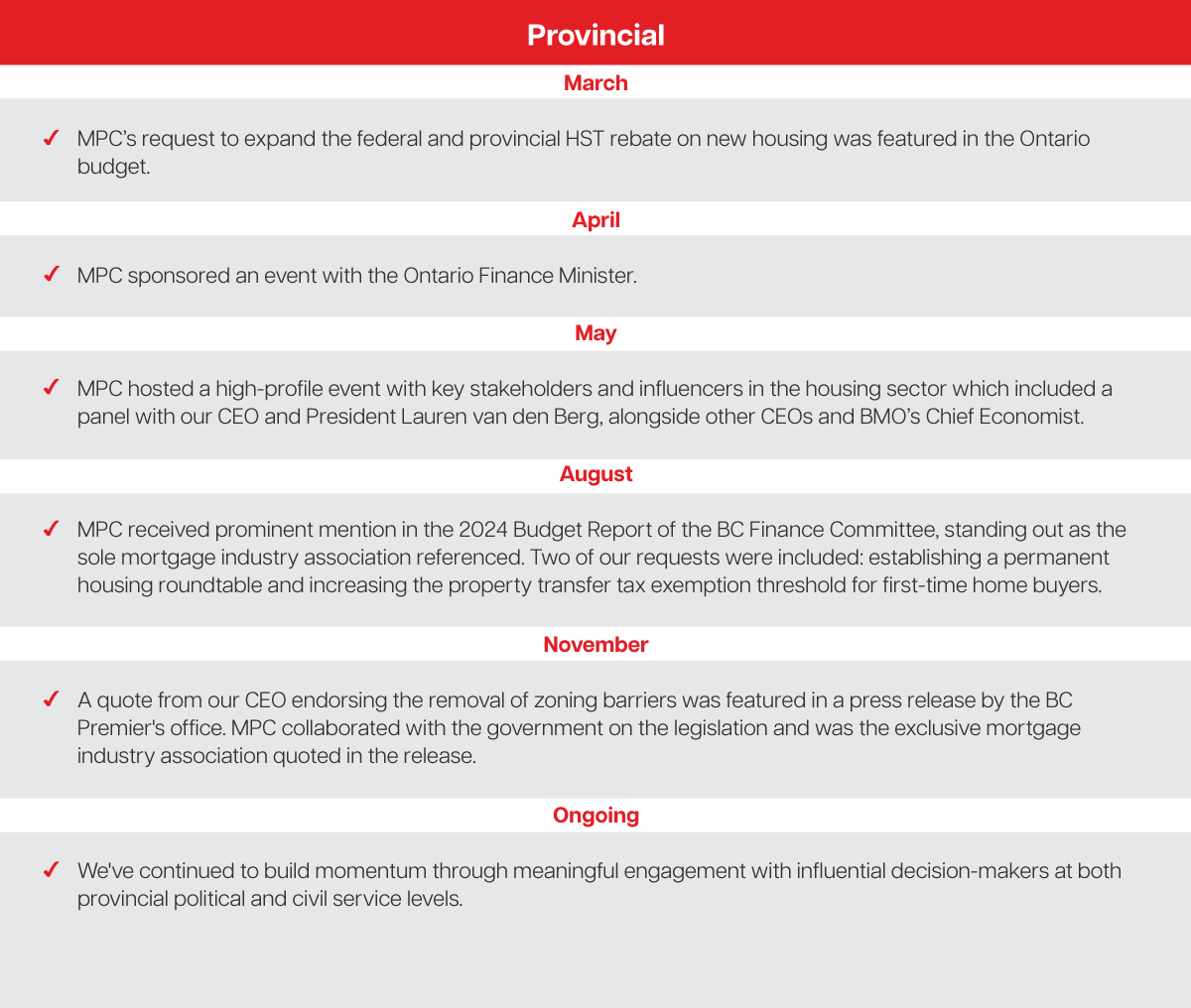

At the provincial level, we advocate for policies that will increase the supply of housing while making homeownership more affordable. Some examples of the housing affordability measures we advocate for include: reducing tax for homeowners and increasing tax incentives for first-time home buyers. We also actively engage on legislative and regulatory matters such as advertising, licensing, education and regulatory requirements with member input.

Some recent successes include:

The 2023 Ontario budget is focused on improving housing supply by advancing the province’s More Homes Build Faster measures

On March 21, 2023, Finance Minister Éric Girard presented Québec's 2023-2024 budget. In addition to fulfilling several campaign promises, this budget is anchored in two major realities: the threat of an impending recession and an inflationary surge that is not yet under control.

On March 6, a team of MPC Québec members and members our government affairs consulted met with the minister of Finance office to discuss our pre-budget submission.

Read our recommendations on B.C. Government’s Proposed Cooling-Off Period Legislation & Other Measures.

Over the past several weeks, we have been active in representing B.C. members to government officials.

A new process will be in place as it relates to mortgage broker licence applications.

Enhancing the protection of consumers who work with mortgage professionals in Ontario.

.png?sfvrsn=b033ea2b_0)

We thank the Ontario Government for working with mortgage brokering community.

d4a0ca31d03440d18b68a86fbbdd877c.png?sfvrsn=ac948a9c_0)

MPC Ontario Chapter members volunteers met with MPPs to discuss the state of local mortgage and real estate markets and more.